Malta Real Estate Market: Prices, Trends, Forecasts

Over the past decade, Malta has seen a surge in real estate investment. The growing demand for real estate had a decisive effect, as a result of which more apartments in different price ranges appeared on the market. During this period, there was also an increase in foreign interest and investment.

In the last months of the pandemic, Malta's housing market has received more attention than usual. For better or worse, Maltese people have long had a strong attachment to real estate, and this is unlikely to change in the near future.

Historically, if Maltese people have the means, they want to be homeowners, and this is firmly rooted in Maltese society. This is evidenced by the level of home ownership in the country, which has always been high and now stands at 78.8% in 2018 (NSO). Since home ownership is very important, Maltese parents often help their children become home buyers.

Localities with the highest average price growth and decline (19Q4 - 20Q4)

Highest average price increase

|

Ghasri |

8.1% |

|

Manikata |

7.2% |

|

Kalkara |

6.7% |

|

Marsalforn |

4.6% |

|

Nadur |

2.3% |

|

Santa Lucija |

2.3% |

|

Qala |

2.2% |

|

Xewkija |

2.2% |

Largest average price decrease

|

Madliena |

-2.9% |

|

Mtarfa |

-2.5% |

|

Valletta |

-2.2% |

|

Senglea |

-1.9% |

|

Cospicua |

-1.9% |

|

Lija |

-1.9% |

|

Floriana |

-1.8% |

|

Burmarrad |

-1.8% |

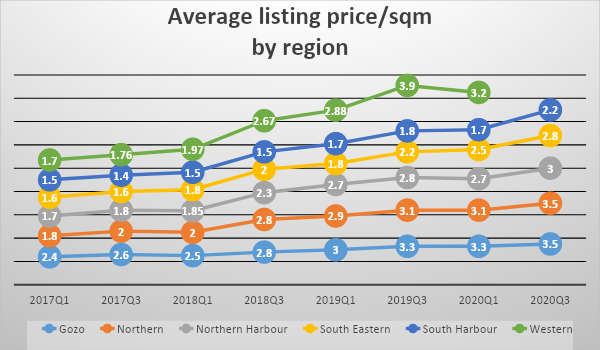

Average prices per sqm

Average prices on the market showed a general slowdown in price growth during 2019 and 2020.

Average prices per square meter have remained mostly stable since mid-2019 in all regions. In recent quarters, there have been weak growth trends in the Southeastern region and the Gozo region and a downward trend in the Northern Harbor region.

These observed trends in prices/sq.m may also be due to changes in the structure of the size of real estate in the region, given the observed negative relationship between these two variables. A large proportion of smaller properties listed in the region (with usually higher prices/sq.m) may lead to an increase in average rates, and vice versa. For example, it is noted that the increase in the price/sq.m for Gozo in the 2nd quarter of 2020 coincided with a relatively large drop in active offers in the same region. It is possible that during this period the owners of larger properties were withdrawn from the market.

Average price/sqm by property type

The lowest average price per sq.m is recorded in Gozo at 1,600 euros per sq.m, while the highest price in the Northern Harbor region exceeds 3,000 euros per sq.m.

Average price/sqm by property type

|

Region |

Apartment |

House of Character |

Maisonette |

Penthouse |

Terraced House |

Townhouse |

|

Gozo |

€1,449 |

€2,186 |

€1,477 |

€1,810 |

€2,334 |

€1,736 |

|

Northern |

€2,319 |

€3,278 |

€2,256 |

€2,825 |

€3,927 |

€3,039 |

|

Northern Harbour |

€3,126 |

€3,083 |

€2,517 |

€3,042 |

€3,543 |

€3,385 |

|

South Eastern |

€1,986 |

€2,282 |

€2,061 |

€2,231 |

€2,831 |

€2,366 |

|

Southern Harbour |

€2,322 |

2 €3,051 |

€2,357 |

€2,166 |

€2,849 |

€3,023 |

|

Western |

€2,174 |

€2,930 |

€2,312 |

€2,583 |

€3,754 |

€3,019 |

Property investing in Malta: the pros and cons

The real estate market in Malta has several advantages that distinguish it from other European countries.

- Rating agencies note the steady growth of the Maltese housing market. Malta held a leading position in the EU in this criterion from 2014 to 2016. At the end of 2016, the growth rate almost reached the 5% mark compared to the same period in 2015. Rental prices are also rising.

- With regard to price changes, analysts' forecasts are only positive. Even more — a real boom in the popularity of Maltese housing is expected in the near future. Among the reasons are the best economic indicators, extremely low unemployment, high quality of life, social and medical support.

- The small area of Malta's territory leads to a shortage of land for development, especially in the central part of the country, which generates greater demand for already constructed facilities. As a result, this leads to a steady increase in prices.

- The high density of development of the main cities — Valletta and Mdina — also leads to a rise in price. The percentage of historical buildings and objects of cultural value is especially high, so investments in urban real estate will pay off.

The real estate market in the republic is very diverse both in terms of housing types and prices.

The most expensive real estate in the capital (Valletta) - a square meter costs an average of 2.2 thousand EUR), objects in Birkirkara are popular (up to 2.3 thousand EUR per m2).

Valletta is the smallest of the European capitals. New real estate is being built a little, so the cost of housing is growing here.

The most interesting for foreign investors are elite specimens located in prestigious resort areas. These are villas, houses, bungalows, townhouses. Penthouses in fashionable residential complexes on the coast are also in demand.

A cottage for 2-4 bedrooms in a small town remote from the sea costs between 400-600 thousand EUR. Medium-sized villas in resort towns (not near the beach) will cost from 500 to 900 thousand EUR, prices for more spacious houses are close to 1 million EUR. For a sought-after object on the first line of the sea, at the water's edge, you will have to pay about 2 million EUR. Luxury villas consisting of several buildings, with a larger territory, swimming pools and a private berth for boats and yachts usually cost at least 7 million EUR. In Malta, you can even buy a landmark — a real castle. Prices for such objects reach 10 million EUR.

The cost of apartments also directly depends on the living space and proximity to the sea. A cozy apartment in Valletta, remote from the water, can cost an average of 100-250 thousand euros, and for luxury penthouses with terraces and sea views in ultra-modern coastal complexes they ask up to 1.8 million euros.

Properties for rent in Malta

The rental market in Malta is growing at a tremendous pace, especially for short-term rentals. Maltese agents cannot cope with the demand in the summer, and the government actively helps those who develop small hotel business, including penthouses and apartments for rent. To be purchased by a foreigner, such housing must cost at least €230,000 euros and have a special rental permit.

- The cost of short-term rental in Malta is calculated daily, long-term — monthly.

- Prices for long-term rentals in Sliema-St Julians start from €1000, in less prestigious areas, but close to the sea — from €600 per month for a one-bedroom apartment.

- The upper "limit" is about €12,000 per month per villa.

- Apartments in an elite complex in Sliema with two or three bedrooms and an open sea view will cost €3000-5000 in winter and €5000-7000 in the summer month.

- The lower "limit" for short-term rentals is €50 in winter, in summer — about €75 for very budget properties.

- Prices for decent housing start from €100 in winter and €150 in summer (and will be higher in Sliema-St Julians).

Apartments in Malta have a long-term rental yield in the region of 4.35-4.49%. For short-term rentals, the yield reaches 10%.

Dynamic Analysis of the Rental Prices in Malta

The main issue that worries all landlords and tenants in connection with the coronavirus pandemic and the cancellation of the citizenship by investment program is what awaits the real estate market in Malta in the near future.

Already aware of all the risks, many owners are in a hurry to transfer their assets from a short-term lease to a long-term one. As a result, the number of offers is growing, which means that rental prices will soon fall.

In some cities of Malta, property prices remained stable in 2021, while in others they decreased or increased.

- In Malta, the most profitable areas for apartments are Attard, Balsam and Lia. In contrast, Tigne Point and Valletta have relatively low returns.

- Most foreigners prefer to live in the central area of the island — in the areas of Sliema and St. Julian's. It is there that the main infrastructure is concentrated — shops, restaurants and offices. In these areas, the most expensive apartments are both owned and rented. Maltese elite complexes are also located here. The prices for renting a one-room apartment in them can be 2000 € per month and above. The minimum price for a long-term rental of a one-bedroom apartment in these areas is now 600 € per month.

- The simpler areas are St. Paul's Bay, Bujibba, Marsaskala, Birzebbuja. Rental prices in them start from 500 € per month.

The cost of long-term rental housing is the lowest on the island of Gozo. The most expensive rental options are located in the North and South Harbor regions. The percentage index for the country's cities was calculated by the Central Bank of Malta. The average cost under the lease agreement in the city of Sliema is taken for 100%.

Index of prices for long-term rental housing in different cities

|

Location |

City |

Index |

|

North Harbor |

Slima |

100% |

|

South Harbor |

Valletta |

91,2% |

|

North Harbor |

St. Julian's |

90,3% |

|

North Harbor |

Gazira |

75,1% |

|

Northern region |

Naxxar |

66,2% |

|

Western region |

L-Iklin |

64,8% |

|

South-eastern region |

Marsascala |

53,7% |

|

Gozo |

Ир-Рабат |

47,2% |

Malta: Mortgage credit interest rate

The Central Bank of Malta has published statistics on the interest rates applied by monetary institutions in Malta on deposits and loans of eurozone residents in euros, as well as data on the volumes (amounts) of new loans in euros to eurozone residents for the reference month of January 2021. These statistics are included in the February 2021 issue of Monetary and Financial Statistics.

The main changes in interest rates on new deposit and loan contracts, including contracts whose terms have been revised, are summarized as follows:

Deposit rates

- The interest rate on household deposits with an agreed maturity of up to one year remained unchanged at 0.09% compared to the previous month.

- The corresponding interest rate on deposits of non-financial corporations increased to 0.10% compared to 0.09% in the previous month.

Credit rates

- The consumer loan rate increased to 3.24% compared to 3.11% in the previous month.

- The interest rate on home loans decreased to 2.22% compared to 2.17% in the previous month.

- The interest rate on loans to non-financial corporations in the amount of up to 1 million euros increased to 3.41% compared to 3.19% in the previous month. The interest rate on loans to non-financial corporations in the amount of more than 1 million euros fell to 3.17% compared to 3.36% in the previous month.

Amounts of new loans

The total volume of new loans decreased to 207.0 million euros in January 2021 compared to 356.5 million euros in the previous month. The main categories of new loans are analyzed below:

- New consumption loans decreased to 11.8 million euros compared to 20.4 million euros in the previous month.

- The volume of new loans for the purchase of housing decreased to 76.2 million euros compared to 112.0 million euros in the previous month.

- New loans to non-financial corporations in the amount of up to 1 million euros decreased to 49.4 million euros compared to 54.6 million euros in the previous month.

- New loans to non-financial corporations in the amount of more than 1 million euros fell to 61.7 million euros compared to 158.2 million euros in the previous month.

Which banks offer housing loans in Malta?

All major local banks offer mortgage loans to buyers of real estate in Malta, including:

What documents are needed to apply for a housing loan?

Property buyers are usually asked to attach the following documents to the mortgage application:

- Preliminary agreement

- Passport

- Address confirmation

- Proof of income

Malta sees economic growth

Malta's economy is projected to grow by 5.4 percent by 2022, as net exports will be the main source of GDP growth, while domestic demand will make a slower but steady contribution.

The economic growth forecast for 2022 is the largest among all EU member states, and tourism is expected to grow to almost pre-pandemic levels by the end of 2022.

Inflation in 2020 averaged 0.8 percent, down from 1.5 percent in 2019, mainly due to low energy prices and lower inflation in the service sector amid declining demand.

Inflation is expected to rise to 1.3 percent in 2021 amid a recovery in domestic demand and an increase in demand for tourist services. In line with a stronger economic recovery, inflation should rise to about 1.6 percent in 2022.